Financial firms have not been exempt from the spur in cybersecurity attacks. According to the 2022 Verizon DBIR report, “The Financial sector continues to be victimized by financially motivated organized crime, often via the actions of Social (Phishing), Hacking (Use of stolen credentials) and Malware (Ransomware).” Therefore, to protect and secure customer data and meet compliance regulations, financial firms need to ensure they have security controls and practices in place.

In this blog post, we provide a comprehensive guide into the cyber risks financial firms are facing, explain which practices can help, and detail the role of browser security in reducing financial firms’ attack surface. Read on to learn how you too can prevent fraudulent actions on your customers’ most valuable data.

Cyber Security Risks in Digital Banking

Financial institutions, like banks and insurance companies, face a range of cyber risks that could threaten the confidentiality, integrity, and availability of their sensitive data and financial systems. Here are some common cyber threats and risks financial institutions are facing:

Phishing

Phishing is a type of cyber security attack in which attackers send deceptive emails or messages, disguised as legitimate communication, to trick users into providing sensitive information. Such information could include login credentials, financial data, or other PII. Phishing attacks are a significant security risk for financial firms because they can be used to gain unauthorized access to user accounts, steal sensitive financial data, and initiate fraudulent transactions.

Phishing websites are also a type of phishing attack, and they are becoming more prevalent. In such attacks, malicious links direct users to fake websites that look like legitimate banking or financial websites. These fake websites can then collect sensitive information that can be used in the aforementioned fraudulent transactions, such as usernames, passwords, and credit card numbers.

Malicious Browser Extensions

Malicious browser extensions are external, third-party extensions that compromise devices by installing malware on them. This malware can be then used for stealing sensitive data, conducting ransomware, or gaining access into the network, and then progressing laterally into the network to more sensitive resources and systems.

For example, compromised plugins might intercept and capture bank account login information as users enter it, giving attackers the ability to steal funds from user accounts. In addition, these extensions might be used for redirecting users to financial phishing sites.

Software Vulnerabilities

A software vulnerability is a weakness or flaw in software code that can be exploited by attackers to compromise the security of a system. If a financial firm’s web application or website is vulnerable, attackers can use that vulnerability to bypass security controls and gain access to user accounts, obtain confidential information, or commit fraud.

SQL Injection

SQL injection is a type of web application security vulnerability that allows attackers to execute malicious SQL statements by injecting malicious SQL code into the input field. They are used to extract sensitive data from the underlying database.

Financial firms often store sensitive financial data, such as credit card information or account details, in databases that are accessed through web applications. Attackers can use SQL injection to breach web application security controls and extract sensitive information from these databases. If successful, the attacker can access confidential financial information or compromise the security of the entire financial system.

Third-party Risks

Financial institutions rely on third-party vendors and service providers for various functions, such as payment processing and cloud computing. However, these vendors may have their own cybersecurity weaknesses. If exploited, attackers could leverage the trust between vendors and financial institutions and progress laterally from the third party to the financial firm.

Why is Browser Security Important in Financial Firms?

A solid browser security solution can help financial firms protect customer data and secure their systems and resources. This is essential for these firms to be able to operate in a heavily-regulated industry that is a key player in driving the economy and safeguards people’s most valuable assets.

The main reasons browsing security solutions should be required for financial firms are:

A Browser Security Solution Secures Customer Data

Financial firms handle a large amount of delicate customer data, which includes both personal and financial information. If compromised, the ramifications could be dire. A browser security solution will help safeguard customer data and deter unauthorized access and data breaches.

This protection is indispensable for maintaining customer trust and ensuring PII is not maliciously exploited to perpetrate financial fraud, like identity theft or credit card fraud. These could have an adverse financial impact on customers and the firm itself, as well as a negative impact on the firm’s reputation.

In addition, protecting customer data is obligatory as part of various regulations, like GDPR and PCI DSS. Browser security can help meet these regulatory requirements.

A Browser Security Solution Provides Workspace Visibility & Monitoring

A browser security solution provides financial firms with heightened visibility into browser sessions so they can monitor for security threats, like malware, phishing, and data breaches. By tracking and analyzing user activity and network traffic, firms can identify and respond to security incidents in real-time, for incident response, so they can minimize the impact on their operations and customers.

In addition, visibility helps financial firms pinpoint which resources are susceptible to attacks, enabling them to put security controls in place to protect them.

A Browser Security Solution Supports a Solid Security Reputation

A browser security solution shields financial firms from malicious websites, malware, phishing, and other threats. This helps them demonstrate their commitment to security and their adherence to compliance requirements. As a result, these firms develop and maintain a strong, security-focused reputation.

Such a reputation helps build trust with customers, legal entities, other business entities, and government agencies. This increases the chance of customers doing business with them, having consistent access to funding, maintaining influence, less regulatory scrutiny, being able to get assistance and benefits, and streamlining operations and needs.

How Can Financial Institutions Prevent Cyber Threats?

Financial institutions can prevent cyber threats by implementing a multi-layered approach to cybersecurity. Here are some key steps that financial institutions can take:

- Conduct a Risk Assessment: For identifying vulnerabilities and threats to systems and data. This will help to prioritize cybersecurity efforts and investments.

- Implement Strong Access Controls: For preventing unauthorized access to systems and data. Browser security solutions can provide an extra layer of authentication.

- Educate Employees: Employees are often the weakest link in cybersecurity. Training and awareness programs help employees identify and prevent cyber threats.

- Implement Security Tools: For detecting and preventing cyber threats. These tools should operate according to advanced security principles like zero trust and the principle of least-privilege.

- Regularly Update and Patch Systems: For addressing known vulnerabilities and reducing the risk of cyber threats. It’s also important to update all devices with antivirus software and all browsers to their most recent versions.

- Conduct Regular Security Audits: For identifying and addressing any weaknesses in cybersecurity defenses.

- Develop an Incident Response Plan: With the required steps to take in the event of a cyber threat or data breach. The plan should be regularly reviewed and updated.

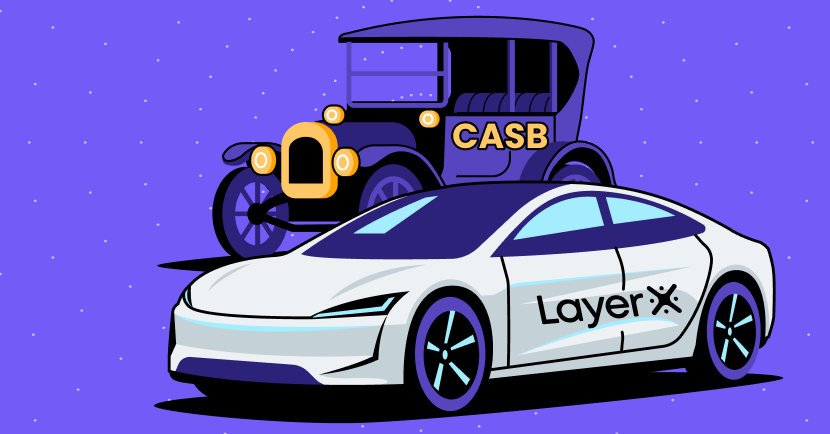

Protect Your Company With LayerX

LayerX is a comprehensive browser security solution designed to provide security and protection against malicious activities within SaaS and web environments. With LayerX, financial institutions can easily monitor all browsing events and gain granular visibility into each user’s activity and behavioral patterns to protect against malicious web pages, phishing, malware, and other vulnerabilities that might result in data theft and leakage.

By configuring dedicated policies for access, limiting data downloads and storage, and additional activity policies, LayerX helps block and prevent any malicious activity. This protection is provided for both managed and unmanaged devices, including third parties. In addition, LayerX ensures a zero-trust approach in the browser and can provide an additional authentication factor for accessing SaaS apps.

With LayerX, financial firms can ensure their customer data is secured, preventing it from being exploited to commit financial fraud. This helps the firm maintain a strong, reliable reputation for both customers and governmental agencies.